vestr – Schedule a call

Let's optimise your workflow.

To help us connect you with the right sales team member or resource, please fill out the form.

vestr is your key to a state-of-the-art client experience. Provide clear and timely insights to clients with diverse needs and challenges while minimizing your operational risk.

.jpg)

.jpg)

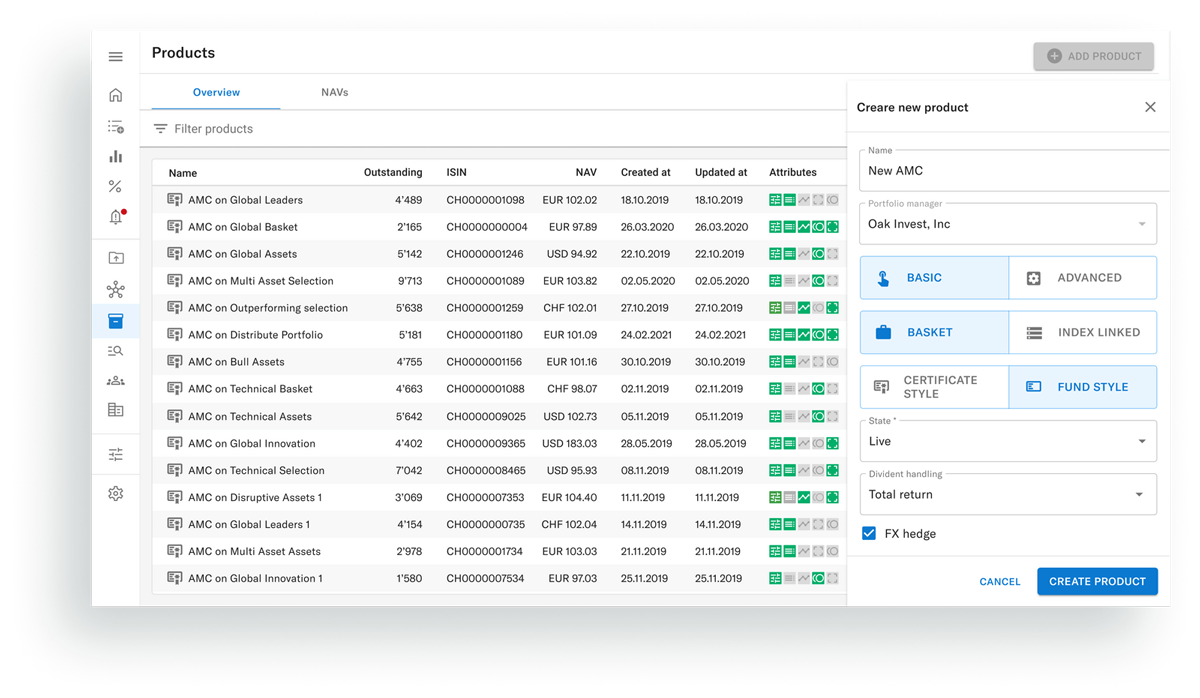

Digitize the lifecycle management of your products

Launch a new product with a few clicks via our platform. From product launch to final fixing- we've got you covered.

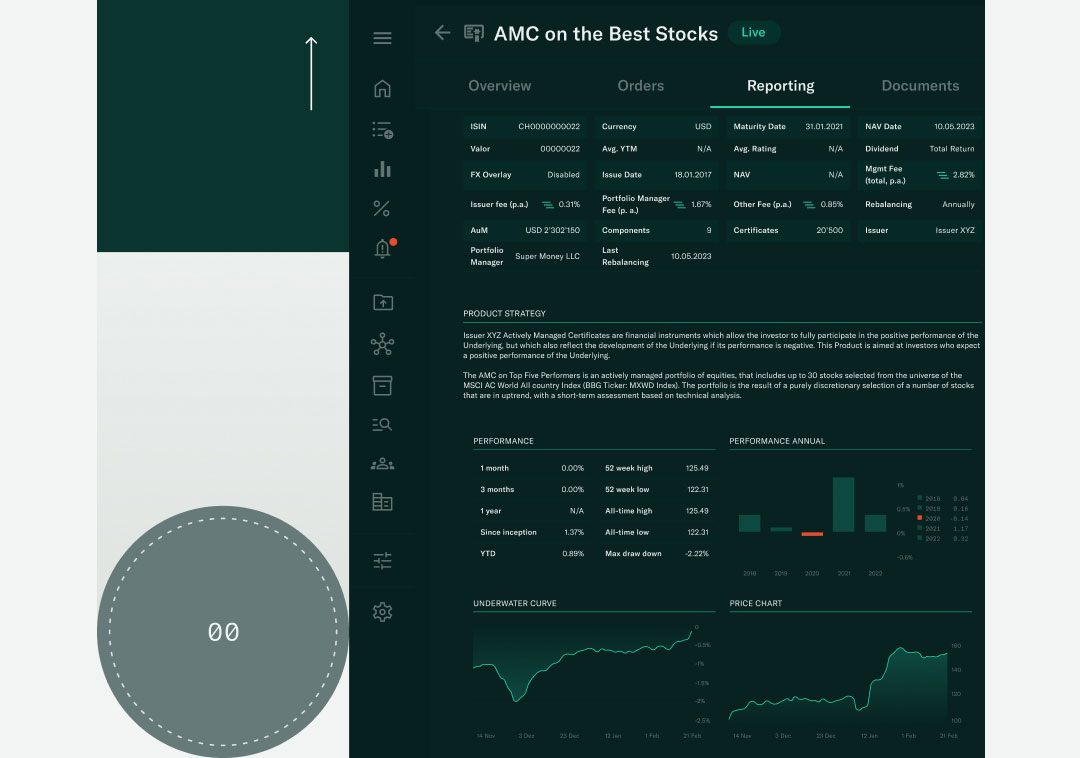

Automate client reporting

With vestr you replace manually generated reports with anytime digital access to customized reports

Pay as you earn

Avoid substantial upfront development costs. With vestr you only pay in relation to your earnings.

Issuing new investment products can be complex and prone to error due to the associated manual processes. By digitizing the issuing process with vestr, you automate and standardize your lifecycle management workflows resulting in increased efficiency, speed and scale.

Say goodbye to manually generated reports and offer your clients real-time access to customized reports, complete with bespoke branding and individually defined charts and KPI. Reporting templates can be stored and shared across your organization.

.png)

While internal development might seem lucrative, the reality is that complex IT asset management software requires high upfront costs and a substantial amount of time.

Our plug-and-play solution allows you to avoid the opportunity cost of sunk capital while the subscription fee corresponds to your actual usage.

-p-1600-1.png)

Active management is still a manual process in many financial services providers bearing a high operational risk. Meanwhile, regulators expect more transparency and disclosure in issuance.

vestr allows you to substantially reduce your operational risk through features such as pre and post-trade checks or monitoring of active and passive breaches.

Solution.

Bank Julius Baer and vestr worked together to explore the opportunities of adopting a cloud-based platform for Actively Managed Certificates (AMCs). By launching a white-labeled platform named EPIC, they created a solution for automated lifecycle management of Actively Managed Certificates (AMCs) and standardized audit reporting across Actively Managed Certificates (AMCs).

Result.

Bank Julius Bär can operate more competitively and focus on its core value propositions. At the same time, the bank can complement its offering with niche products, such as small thematic investments, at realistic listing prices.

Challenge.

Due to their complex process, Actively Managed Certificates (AMCs) are prone to operational risks when managed manually. Bank Julius Bär was looking for a solution to meet the demand for frequent rebalancings, smaller products, and customized reporting.

"

The flexible vestr platform empowers our clients to create and manage Actively Managed Certificates (AMCs) in a high-performing and intuitive way, while at the same time streamlining internal processes.

.png)

To help us connect you with the right sales team member or resource, please fill out the form.

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua.